House Price Index Reports UK, The Economy & Buyer Sentiment

Friends,

I have reviewed a number of publications and pulled together a memo that give some clues for what’s happening in the market.

Summer slow down & what is driving the market

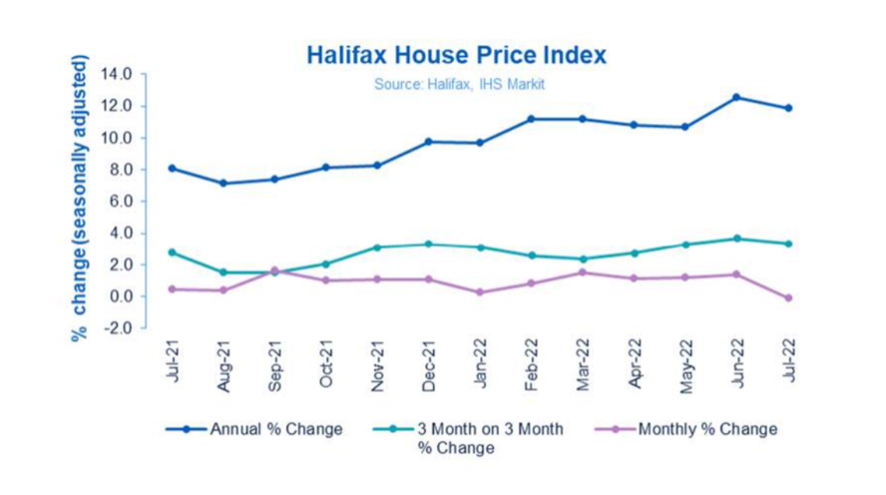

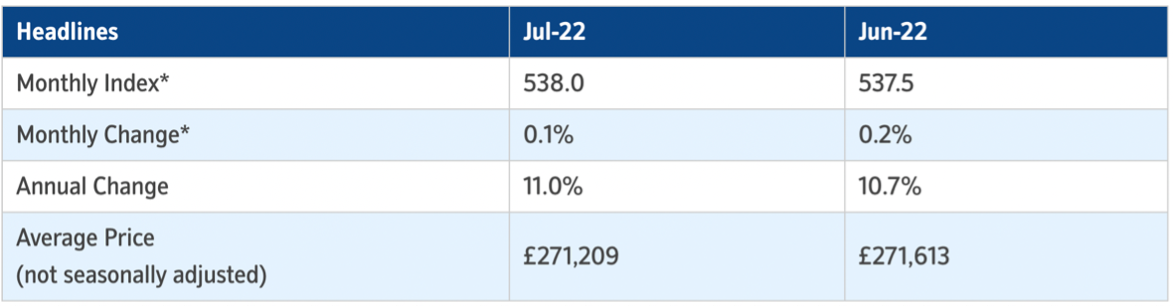

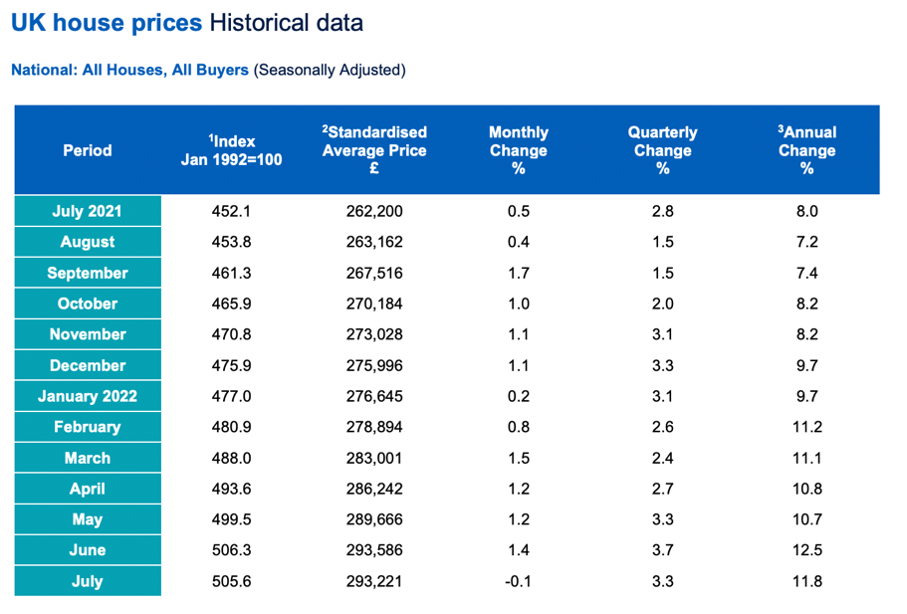

HPI up 7.8% in the year to June 2022 with the Halifax HPI showing a marginal drop (0.1%) in June easing annual growth from 12.5% down to 11.8%, Wales continues to show the strongest growth.

Russel Galley, MD of Halifax, commented its important to note that despite this easing of inflation ‘house prices [on average] remain more than £30,000.00 higher than this time last year’.

But who’s buying what?

The Halifax HPI noted that for the first time since the onset of the pandemic first time buyer purchases dropped noticeably from 12.4% to 10.7%. Bigger houses are noticeably outpacing demand for smaller starter homes with the price of detached increasing by £60K (15.1%) over the last year, compared to £11.9K (7.7%) for flats.

Its worth noting the change here works against rental trends in an inflationary environment, as the affordability crunch really gathers pace, we predict a scaling down of space by renters moving from larger units with work from home office space, into smaller units. The financial incentive to keep warm at the office instead of at home will soon become clear. Echoing this in the market according to Zoopla, three bedroom houses have been the most in-demand properties for the middle of the year, accounting for 44% of enquiries a hangover from the pandemics ‘search for space’.

Galley stated that supply & demand imbalance remains a strength of the market ‘drivers of the buoyant market … still remain evident’ the short supply of homes remains a long term challenge unpinning high property prices.

July identified as the 12th month of double digit growth by Nationwide HPI.

Nationwide’s Chief Economist Robert Gardner noted modest increase in the month of July, up to 11% annually from 10.7% in June. Noting the market retained a surprising degree of momentum despite the increasing pressures on household budgets from the inflationary environment the economy sits in having driven consumer confidence to all-time lows.

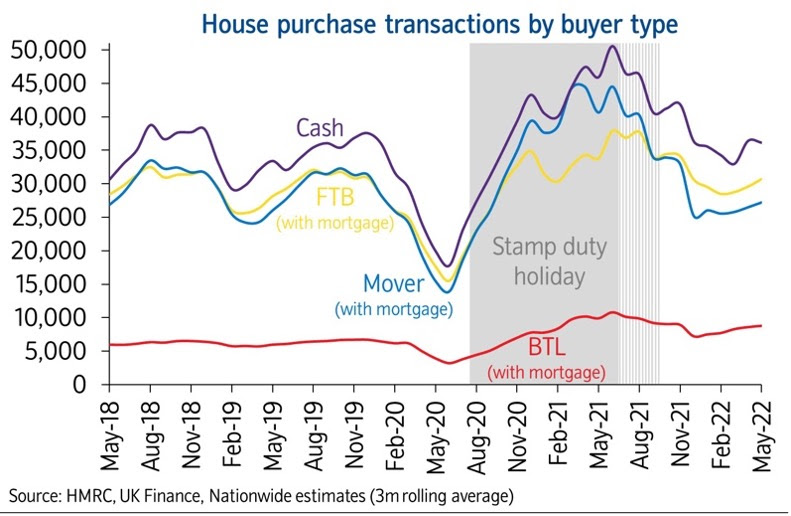

Transactions across buyers in the 3 months to the month of May were circa 20% below the levels resulting from the stamp duty holiday in 2021, but remained 5% above pre-pandemic levels.

Home-mover transactions (with mortgages) slowed more than other sectors, we predict largely due to the persistent low stock on the market and having fixed for new terms at record low rates. Looking ahead to the rising rates environment there is a forecast that vendors who were hesitant about selling might consider the Autumn their last chance before a period of rate rises makes it unaffordable to achieve the current prices being recorded by the market.

First time buyer completions remain C.5% above pre-pandemic levels, despite growing affordability concerns. The Bank of England move to reduce the stress test in line with the affordability crunch is to help those who are close to affording get over the hurdles that they need to cover off affordability.

Buy to let purchases with a mortgage remain higher than pre-pandemic levels. Sentiment is likely buoyed by the fact that rental demand remains very strong, with upward pressure on rents encouraging landlords to enter the market particularly if they view property as a hedge against inflation.

I would love to hear from you:

What are you seeing in your market today? Does it marry up with the findings of these nationwide averages?

Kindest,

Dan & the Team

Sources:

– Halifax House Price Index

– Nationwide House Price Index

– HMRC & UK Finance

– The Financial Times & The Economist