Our Autumn 2021 Budget Review!

Our Key Takeaway Points:

The Economy Is growing at a high rate right now with annual growth set to be 6.5% for 2021, and a forecast of 6% for 2022, the medium-term impact of covid has been less severe than previously thought, with unemployment down on forecasts. Wages have grown in real terms by 3.4% and the availability of labor is lower than expected with specific shocks to trades such as butchers, and HGV drivers. The economy is set to reach pre-covid levels around the year end.

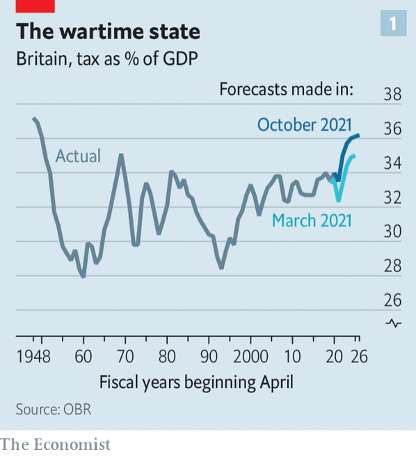

Government debt has not been higher in recent years, with Borrowing at 7.9% of GDP, the chancellor’s general position is higher taxes now and reduced spending later. By raising tax revenues now, and being freer with the public purse, the chancellor will have, he hopes, more room for giveaways around the time of the next election.

Covid debt and public spending has been high in an attempt to stimulate the economy, Gov spending has been its higher since post war years. The budgets response of raising these taxes, again mirroring the trend of borrowing for recent years is also set to be the highest tax rate since the 1950s, rising from 33.5% of GDP to 36.2% of GDP.

UK GDP predicted to be 2.28 Trillion for the year 2021

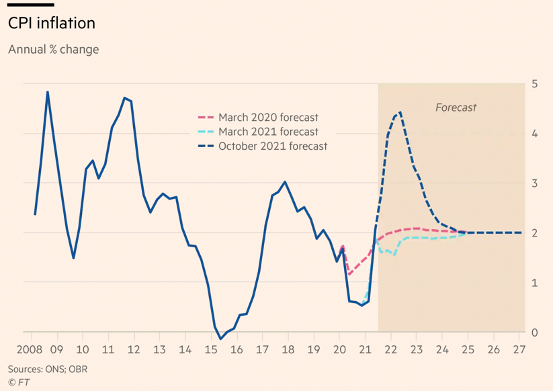

The reality of inflation is that consumer prices index is set to average 4% for the next year, with September’s rate of Inflation recorded at 3.1% and only the beginnings of musings around a rate rise from the Bank of England suggests that this trend still has some run rate. In the public debt markets investors are betting on Bank of England rates to reach 1% before the Autumn of 2022.

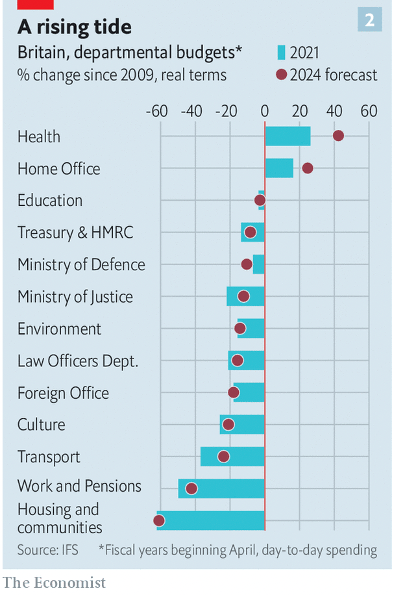

Government departments will receive real (inflation adjusted) increases in their budget of 3% a year until 2024/25, this is a significant commitment with inflation that could be as much as 5% with 4% almost a foregone conclusion. This level a big state government was last seen consistently in the 2000’s, not the Chancellor George Osborne, but Labour’s Gordon Brown.

The Office for Budget Responsibility (OBR) forecast spending to grow from 39.8% of GDP before the pandemic to 41.6% by 2026/27, the highest sustained rise since the 1970s, another nod to big state conservatism and spending.

The OBR predicted GDP growth of 4.1% for this year in March 2021, revising that upwards to 6.5% following positive employment figures paints the economy in a rosier picture going forward, but how much of this is propped up by record low borrowing rates and the great wave of covid support packages, both of which are not sustainable long term solutions. A second prediction around the medium term damage expected from Covid-19 has been revised down from 3% GDP to 2% GDP, again following strong employment numbers from and optimistic inbound investment, The Chancellor made several pushes toward innovating the British economy and his positioning for a global technology, and research and development hub supported by the governments UK Life’s sciences vision.

This year saw the biggest tax rise since 1993, a message the Tories will not be putting out for the next election, Chancellor rishi sunak made mention in the speech on Wednesday that his ambition for the next few years is to raise taxes in the short term before loosening policy leading into the election. The question of whether this budget is too far much big government spending for Traditional conservative supporters will remain to be seen. In announcing the new fiscal rules, the ambition will be no borrowing for day to day spending and that debt will fall as a share of GDP.

What does this borrowing mean for the Portfolio Landlord?

Tools to tackle inflation are reducing money supply and raising borrowing rates, now is a great time for Borrowers to lock in fixed 5-year deals, or take advantage of very cheap 2-year deals.

Latest BTL Borrowing at 75%:

2-year deal: Circa 2.4%

5-year deal: circa 3.2%

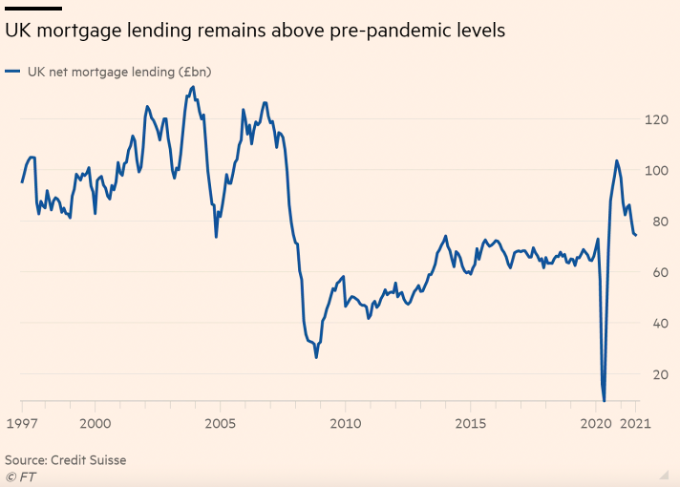

With UK mortgage lending remaining above pre-pandemic levels and a rate rise possible as soon as the monetary policy meeting on 4th November, borrowers could quickly see mortgage rates rises hitting their portfolio’s.

Richard Donnell, Head of Research at Zoopla cited a rate rise, dwindling supply of homes coming to market, and sellers getting too ambitious about what they think their homes are worth as a trio of headwinds putting downward pressure on the market.

The budget introduced a residential property developer tax on profits over £25M of 4%, a punitive tax moving against developers while banks benefited from a 3% surcharge being removed from their profits.

Overall the budget has not given us a huge amount to shout about, a number of the increases in tax were pre-released, national insurance, the bumping of corporation profits, with many other reliefs remaining largely the same, a huge number unchanged and some with slight tweaks.

The biggest change to us appears to be the increase in government spending, big state conservatism has arrived. In addition to big budget for responsible spending these have been inflation adjusted increases, a real kicker considering the rate at which inflation has been cited and pegged.

How this Borrowing will be sustained with forecast rate rises will be a challenge for the sector, but tax receipts on the increase and inflation pushing incomes into higher paying brackets is a factor many omit when considering the freeze on allowances at the nil, basic and additional rate.

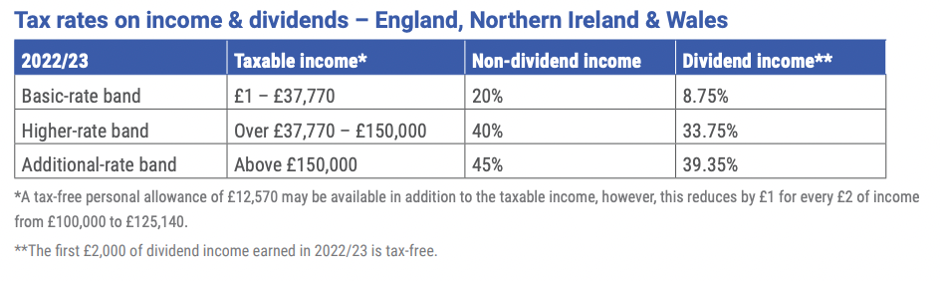

How Income Tax and Dividends will change: Personal income, largely unchanged, dividend increase by 1.25%.

Rates and allowances remain the same, with £12,570 personal allowance, a basic rate of £37,700 and the additional rate remains unchanged at £150,000. Dividends are being squeezed with a marginal rate rise in each bracket, up by 1.25% across each bracket, with many other reliefs remaining fixed.

Living Wage: 6.6% Increase The national living wage for over 23’s will be £9.50 an hour from 1st April 2022, up from £8.91, an increase of 6.6%.

Capital Gains Tax: Unchanged Annual allowances remain in place for £12,300 per annum until and including the 2025/26 tax year. With Lifetime limit on qualifying gains for business asset relief remain at £1m for 2022/23, at 10%. Lifetime limit for investors’ relief, again, remains unchanged with a 10% tax rate and kept at the current level of £10M.

CGT on Property: 30 day’s more! Sale of UK residential property for UK and non-UK residents, completing after 27th October will have 60 days to settle their CGT bill as opposed to the previous 30 day period. A cashflow assistance for developers, but not a huge assistance for a very short term tax timeline.

A measure available to UK residents disposing of a mixed use property will mean they only report and pay the gain on the residential portion of the asset.

ISAs, Pensions and Inheritance tax: Unchanged All remain unchanged, ISA 20K, Pension Lifetime allowance remains £1.073M until 2025/26 and inheritance nil rate band remains £325K.