Quarterly Review – Helicopter Money

Helicopter money; central government supplying large amounts of money to the public, as if money was being scattered from a Helicopter – Milton Freedman.

As we review the quarter and put it into the context of last year, please see our economic commentary below.

Buy to Let Lending:

Buy to let products through the first quarter of 2021 have started showing signs of a return to pre-covid leverage, beginning the year with 75% products as the top end, we now have options at 80% returning at less than 4%, Kensington is even offering 85%. That’s not to say credit it easy, with furlough and bounce back loans being taken out in their droves buy to let lenders are very wary of the source of funds for deposits, looking at the granular detail to assess an applicant, their leverage, reliability of income. Bridging finance is less rigid in its underwriting but not every Lender is able to deliver with the speed & certainty that some project requirements dictate.

UK Residential overview: 2020 looking back

In the year to end of 2020 house prices appreciated 8.5%, with a sharp uptick beginning around Q2 of 2020. Specifics of regional house price growth far outpaced London’s 3.6% gain. The Southwest, East Midlands, Yorkshire & Humber, North West, & Wales all appreciated >10%, the South East and East recorded growth in the mid-range, where the stamp duty holiday’s effect was less pronounced than the regions, but more acute than within London.

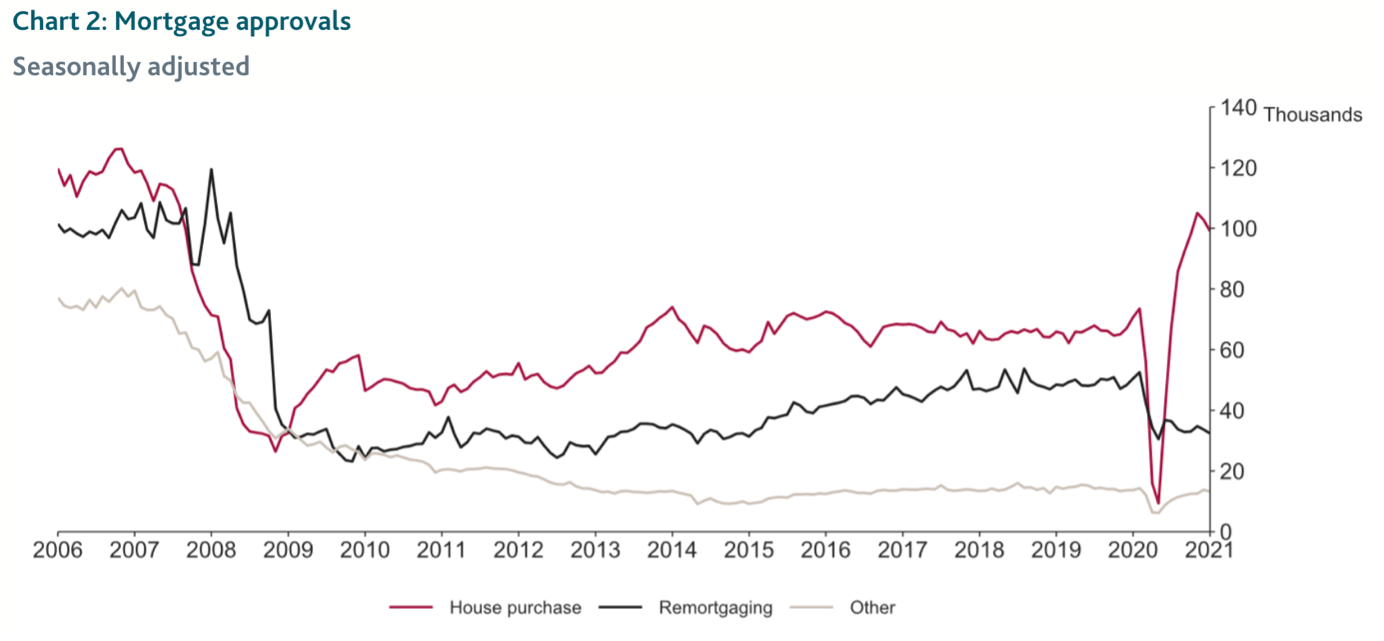

The year end found the average house price of all types of homes in the United Kingdom pass £250K for the first time, buyer sentiment remained high through the first quarter of 2021 though mortgage approvals were down 33% in December 2020 versus Novembers numbers (78K : 104: respectively). January’s approvals confirmed at 99K cases, more on millennial money in our wider economy section.

House Prices for Portfolio Landlords:

Buy to Let investors purchasing within a company for less than £125,000 have been absolutely unaffected in terms of purchasing costs, beyond this price point there is a 2% saving on the stamp duty holiday. The most significant affect is broader market sentiment leading to margins of safety being eroded through competitive bidding. This double-edged sword poses a challenge to securing the best purchase point for new projects, but appreciation will benefit existing portfolios. Greatest success among our borrowers has come from consistently following up on offers over a 12 – 24 week period, the “farmers” of the offer database, and those who have been consistently following a direct to vendor marketing strategy.

The Rental Market:

The rental market in the regions remains strong, with a real scarcity of good quality and sized property. In the North West, good quality 3 bedroom rental stock is in short supply and this is not an isolated issue, the same can be said to be true of Wales, where real rental values are also rising. The Multiple occupancy market is moving toward larger more isolated rooms with shared communal facilities, with some markets moving from shared facilities to studios, the London shared accommodation market is particularly soft and has remained so since the middle of 2020.

The Wider Economy: Helicopter Money and how it feeds into Property

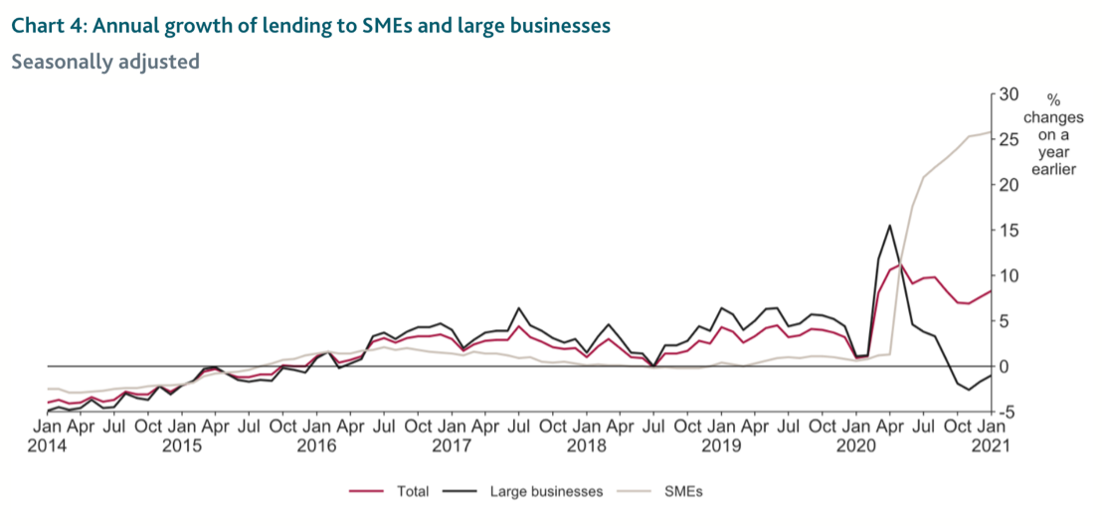

Lending to small and medium sized enterprises (SMEs) has historically been significantly more difficult to unlock than larger business loans. The sharp rise comparative to recent lending available to large business has reversed, this is due to Corona virus business interruption loans (CBIL) and for Bounce Back Loans or (BBL). This was used to support businesses, and keeping trade going.

Whilst Hospitality has borne the brunt of the pandemic, other industries such as construction, and professional services have remained largely unscathed. The loan buffers have built a ‘war-chest’ on the balance sheet of these businesses enabling them to capitalise on other weaker market conditions.

The United Kingdom Economy has long been driven by the services sector, accounting for approximately 80% of GDP in 2019, the sector has easily transitioned to a remote working environment. With many salaries remaining constant, and some young professionals even doing away with the significant liability of rent (up to 50% of monthly income in major cities). By boarding with Mum & Dad this demographic is priming itself to become first time buyers to enter the PPR Market.

The labour market has historically sat between 5 and 10% since 1990 in the UK, with unemployment peaking in 1993 at 10.35%, falling to 4.7% in 2001 and hovering around that range until 2008 where it climbed to >8% in 2011. Whilst analogies can be drawn from 2008 the covid pandemic has been very different, there has been no shortage of funds to transact and keep the wheels of the economy turning but instead an embargo on some businesses carrying out trade. The current unemployment figures for March 2021 sit just below 5% mark, but the continued furlough scheme to September 2021 has artificially kept this down.

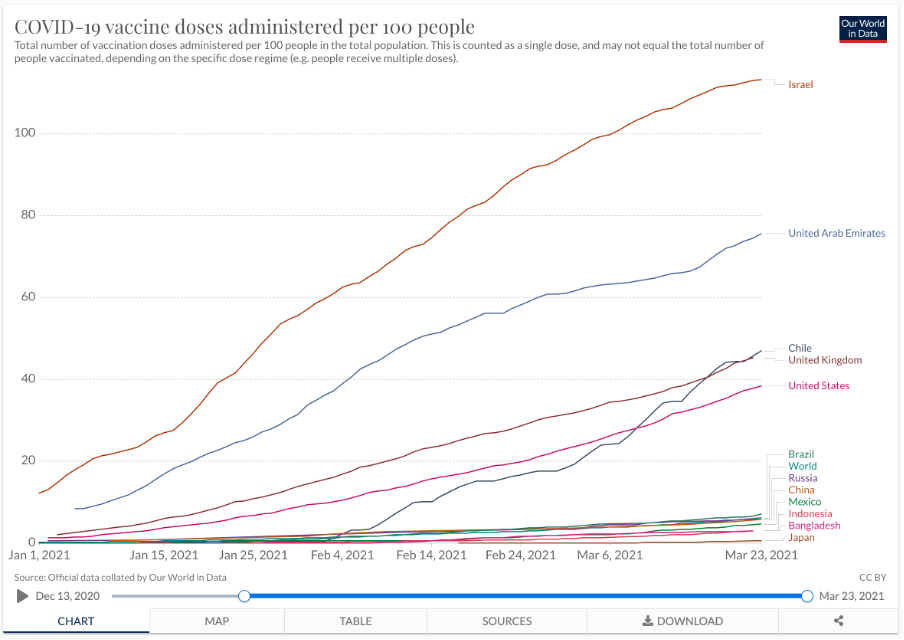

A note of positivity on the exit path from virus territory is that the vaccine rollout has been comprehensive across the UK, there is good reason to be bullish on a reopening in the near future and a return to a lockdown free economy, taking us off the furlough drip. The current unemployment figures for March 2021 sit just below 5% mark, but the continued furlough scheme to September 2021 has artificially kept this down. A note of positivity on the exit path from virus territory is that the vaccine rollout has been comprehensive across the UK, there is good reason to be bullish on a reopening in the near future and a return to a lockdown free economy, taking us off the furlough drip.

The labour market has historically sat between 5 and 10% since 1990 in the UK, with unemployment peaking in 1993 at 10.35%, falling to 4.7% in 2001 and hovering around that range until 2008 where it climbed to >8% in 2011. Whilst analogies can be drawn from 2008 the covid pandemic has been very different, there has been no shortage of funds to transact and keep the wheels of the economy turning but instead an embargo on some businesses carrying out trade. The current unemployment figures for March 2021 sit just below 5% mark, but the continued furlough scheme to September 2021 has artificially kept this down. A note of positivity on the exit path from virus territory is that the vaccine rollout has been comprehensive across the UK, there is good reason to be bullish on a reopening in the near future and a return to a lockdown free economy, taking us off the furlough drip.